Claim Your

FRESH START!

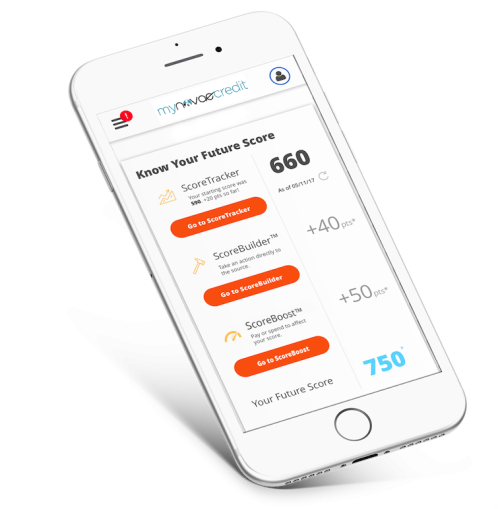

Track It, Build It, Boost It!

Learn How to BUILD, TRACK, and BOOST Your Credit Score with

myNovaeCredit Monitoring!

ScoreTracker

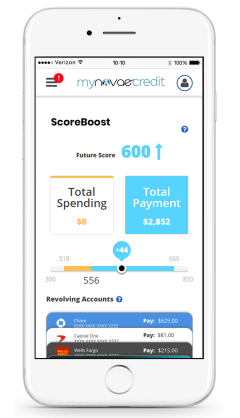

ScoreBoost™

Be the master of your credit score! Use Novae ScoreBoost® before you apply for credit, make payments or spend money.

About Novae ScoreTracker

About Novae ScoreBuilder®

Take Action - View your negative accounts weighing down your score and take action to take care of them.

About Novae ScoreBoost™

Spending - See how your spending can lower your credit score. Balance the spending between your accounts and know the optimum time to repay.

Payments - See how your payments can increase your credit score. Know how much to pay and by when.

Monitoring - We will actively monitor your credit cards and credit report to alert you of changes and detect fraud as your credit score changes.

Plus - Your Money, Credit & Privacy Manager!

Money Manager

We automatically find your online accounts making it easy to add to Novae Money Manager. No guessing or searching.

Receive Alerts when payments are due. Easily plan your budget and spending. Your transactions are integrated with your NovaeCredit Report® for the complete picture.

NovaeCredit Report®

A simple and innovative way to view your credit report. Use action buttons to quickly ask questions and resolve problems.

Quickly separate the negative accounts from the positive items, see your auto-score, insurance-score and more!

Privacy & Insurance

Your mobile or email Alerts have action buttons to quickly ask questions and resolve problems.

We instruct websites & data brokers to remove your info from their websites.

Plus, you get $1 million identity fraud insurance for your whole family!

You are securely connected to more than 50,000 banks, brokerages, credit unions, debt collectors and more to help you manage your debt and spending!

See What People Are Saying

Tess M.

"I use the action button almost every day for my money and credit report. Thank you for a simple tool!"

Adrian L.

"Thank you, it is very easy to use. I clicked on the action button to change my address without having to call or write them."

Melissa G.

"I love being able to work on my credit score with ScoreBuilder®."

Brad T.

"ScoreBoost™ is the coolest tool I have ever used. Plus, I love the Alerts with Action buttons."

We Deliver Fintech Tools to

Give Your Credit Score NEW LIFE!

Your credit score is one of the most valuable financial tools you have in life. With myNovaeCredit®'s credit monitoring services, you can insure yourself against identity theft and track not only your credit reports, but your daily credit and financial transactions as well.

Your credit report is like a report card of your entire financial history. With myNovaeCredit®, you quickly receive your 3B credit reports & scores. Plus, we make them easy to read, so you can regularly check their accuracy and better understand your credit score!

With more than nine million Americans experiencing credit card fraud and identity theft each year, the need for identity theft insurance grows every day. Our $1 Million Family Fraud Insurance gives you peace of mind in the event that you or a family member in your household become the victim of identity theft.

Separating the Negative accounts from the Positive accounts is a great way to see what's hurting your score and what may actually not belong on your report in the first place. You can also get more advanced and see any last action or note on each account across all 3 bureaus!

Your credit score plays a vital role in credit decisions and can open the door to many opportunities. Enroll with myNovaeCredit® today and not only are you provided with the different types of credit scores that exist, but also credit score tools that allow you to take more control of your credit score.

Sign up with myNovaeCredit® to get your credit report and to start controlling your future credit score today!

Your credit report contains several pieces of crucial information, such as your credit history, the different types of credit you have previously used, and for how long, any outstanding debts you may have, and how frequently you made payments on the agreed-upon due dates every month.

The data within your credit report is used by various lenders and creditors to determine your financial responsibility, and whether or not you are a risk in terms of extending credit.

Credit reports contain data from four main categories of personal and financial information.

Personally Identifiable Information (PII): Refers to personal information that can be used to identify you, such as your full name, current and previous address, date of birth, and social security number.

Credit Accounts: Each credit account you have opened with various creditors and lenders.

Credit Inquiries: Inquiries are a record of who has accessed you credit report and on what date. Hard inquiries are made each time you apply for a new line of credit, while soft inquiries are made each time you view your credit report.

Public Record and Collections: Refers to personal information such as bankruptcies, debt collections, and any pending legal issues.

However, credit scores are not shown on your credit report because they represent a different insight into your credit. Credit reports indicate your credit activity, while credit scores reflect a calculation of your credit activity.

Credit scores are used by financial companies to help them determine if a consumer has any potential risk in extending them credit. Most often, credit scores are used by financial institutions, credit card companies, and car dealerships to determine whether or not they should provide you with credit, and what the terms, interest rate, and down payment of the credit will be.

Credit score calculations are placed into five categories between the ranges of 300-850:

- Poor: 579 or below

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800 or above

Generally, credit scores above 670 are considered good, and a credit score above 800 is considered to be an excellent credit score. Most consumers fall somewhere between 600 to 750.

As mentioned, the benefit of having higher credit scores represent more financial responsibility, thus providing creditors and lenders with more confidence that you will be able to repay any future debts as agreed upon. Get a credit report today and see where your credit score stands.

To find out precisely what is in your credit report, sign up with myNovaeCredit® to easily receive and manage your 3-Bureau Report & Scores.

The credit reporting agencies are responsible for maintaining your credit report and providing the data to various creditors and lenders who request it. There are three major credit reporting agencies.

- Equifax

- TransUnion

- Experian

However, information that is provided to each of the three credit bureaus may be different due to the individual creditors furnishing your data. For example, one credit bureau may have more or fewer inquiries than the other two, which could potentially produce different looking credit reports.

Because of this, it's recommended that you request your credit report with each of the three major bureaus so that you have a comprehensive look into your financial standing, and quickly identify any difference that could potentially be affecting it.

Monitoring your credit is tough to do on your own. myNovaeCredit® membership provides you with the absolute best platform for your money, credit, and identity all in one.

Sign up to find out how you can start controlling our future credit score today!